Home Office Tax Deductions: What You Can (and Can’t) Write Off When Working From Home

The rise of remote work has created confusion about home office tax deductions. After helping dozens of clients navigate these waters, I’ve found that most people either leave money on the table or claim deductions they’re not entitled to—both costly mistakes.

This guide breaks down exactly what you can write off, what you can’t, and how to stay on the right side of the IRS while maximizing your legitimate deductions.

The Critical Distinction: Employee vs. Self-Employed

Before diving into specific deductions, you need to understand the single most important factor that determines your eligibility:

If you’re a W-2 employee working from home: Unfortunately, you cannot claim home office deductions on your federal tax return for tax years 2018 through 2025. The Tax Cuts and Jobs Act (TCJA) suspended the deduction for unreimbursed employee business expenses, including home office expenses.

If you’re self-employed (sole proprietor, independent contractor, freelancer, or business owner): You can claim legitimate home office deductions, potentially saving thousands on your tax bill.

According to Investopedia, more than one-third of workers were still fully remote or hybrid in 2024, yet many don’t understand these fundamental distinctions.

Self-Employed Home Office Deduction: The Two Essential Tests

If you’re self-employed, you must pass both of these tests to qualify for home office deductions:

1. The Exclusive Use Test

This is the requirement most people fail. Your home office must be used exclusively for business—meaning the space cannot be used for any personal purposes.

What passes the test:

- A spare bedroom converted entirely to an office

- A section of your basement used only for business

- A detached garage or guest house used solely for work

What fails the test:

- A dining room table where you also eat meals

- A guest bedroom with a desk that occasionally houses visitors

- A living room corner where you sometimes watch TV

The IRS is strict about this requirement. If you use the space for any personal activities—even occasionally—you generally cannot claim the deduction.

Exception: There are limited exceptions to the exclusive use requirement for:

- Inventory storage areas in your home

- Licensed daycare facilities

2. The Regular Use Test

Your home office must be used “regularly” for business, not just occasionally.

What passes the test:

- Working from your home office several days each week

- Consistently using the space for business throughout the year

What fails the test:

- Using the space only a few times monthly

- Sporadic or inconsistent use

The IRS doesn’t provide a specific hourly threshold, but the key is demonstrating consistent, ongoing business use.

Additional Qualifying Requirements

Beyond the exclusive and regular use tests, your home office must also meet one of these criteria:

- Principal place of business: Where you conduct most of your business activities

- Meeting place for clients/customers: Where you regularly meet with clients or customers

- Separate structure: A detached garage, studio, or guest house used exclusively for business

Most remote workers qualify under the “principal place of business” criterion, which includes administrative or management activities when you have no other fixed location to perform these functions.

What You Can Deduct: The Two Calculation Methods

If you qualify for the home office deduction, you have two options for calculating your deduction:

Option 1: The Simplified Method

How it works: Deduct $5 per square foot of your home office, up to a maximum of 300 square feet.

Maximum deduction: $1,500 per year

Paperwork: Minimal—no need to track actual expenses

Best for: Smaller home offices or those without significant home-related expenses

Option 2: The Regular Method

How it works: Calculate the percentage of your home used for business, then apply that percentage to eligible home expenses.

Step 1: Divide the square footage of your home office by the total square footage of your home. Example: 200 sq ft office ÷ 2,000 sq ft home = 10%

Step 2: Apply that percentage to eligible indirect expenses:

- Mortgage interest or rent

- Property taxes

- Home insurance

- Utilities (electricity, gas, water)

- Internet and phone service

- Home repairs and maintenance

- Depreciation

Step 3: Add 100% of direct expenses (those that benefit only the home office):

- Office furniture

- Office equipment

- Paint or repairs exclusively for the office space

Paperwork: Requires Form 8829 and detailed record-keeping

Best for: Larger home offices or homes with high expenses

What You Can Write Off: The Complete List

Here’s a comprehensive breakdown of deductible expenses for self-employed individuals with qualifying home offices:

Direct Home Office Expenses (100% Deductible)

- Office furniture and equipment

- Desks, chairs, filing cabinets

- Bookshelves, lamps, area rugs

- Office décor specifically for the office

- Technology and electronics

- Computers, monitors, printers

- Routers, modems, networking equipment

- Specialized equipment for your business

- Office supplies

- Paper, pens, staplers, paper clips

- Printer ink, toner cartridges

- Specialized supplies for your industry

- Direct office improvements

- Paint, flooring, or wallpaper for the office only

- Lighting fixtures installed in the office

- Repairs made specifically to the office area

Indirect Home Expenses (Deductible Based on Office Percentage)

- Housing costs

- Mortgage interest or rent payments

- Property taxes and homeowner’s insurance

- HOA fees

- Utilities and services

- Electricity, gas, water, and sewer

- Internet and landline phone service

- Trash and recycling services

- Home maintenance

- General repairs and maintenance

- Cleaning services for the entire home

- Pest control services

- Home depreciation

- Deduction for the wear and tear of your home

- Calculated based on your office percentage

- Only applies to homeowners, not renters

Other Business Expenses (Fully Deductible, Regardless of Home Office)

- Professional services

- Accounting and bookkeeping fees

- Legal fees related to your business

- Consulting or coaching services

- Business insurance

- Professional liability insurance

- Business property insurance

- Errors and omissions insurance

- Marketing and advertising

- Website hosting and maintenance

- Online advertising

- Business cards and promotional materials

- Professional development

- Courses and continuing education

- Professional books and publications

- Industry conference fees

- Software and subscriptions

- Business software licenses

- Cloud storage services

- Professional membership fees

What You Cannot Deduct: Common Misconceptions

Many taxpayers mistakenly claim deductions they’re not entitled to. Here are expenses you cannot deduct:

For W-2 Employees

- Home office space or setup

- Internet or utility costs

- Office supplies or furniture

- Any unreimbursed employee expenses

Alternative: Ask your employer about reimbursement programs. According to Investopedia, 56% of companies offered reimbursement for work equipment to remote employees in 2024.

For Self-Employed Individuals

- Expenses for non-exclusive spaces

- The first phone line to your home (even if used for business)

- Home office improvements that add value to your home (capital improvements)

- Commuting expenses between your home and another work location

Audit Red Flags: What Triggers IRS Scrutiny

While legitimate home office deductions shouldn’t be avoided out of audit fear, be aware of these red flags:

- Claiming 100% business use of a vehicle The IRS knows most people use their vehicles for both business and personal purposes.

- Deducting a home office that’s also used personally Photos on social media showing your “office” being used for other purposes can be problematic.

- Round numbers on all expenses Actual expenses rarely come out to exactly $500 or $1,000.

- Claiming home office deductions with minimal business income The IRS may question whether your business is legitimate or just a hobby.

- Taking the same deductions every year Expenses naturally fluctuate; identical deductions year after year look suspicious.

Documentation: The Key to Surviving an Audit

If you’re claiming home office deductions, maintain these records for at least seven years:

- Photos of your home office Take dated pictures showing the exclusive business use.

- Floor plan with measurements Document the square footage of both your office and entire home.

- Calendar of business use Track the days and hours you use your home office.

- Expense receipts and records Keep all receipts, bills, and payment confirmations.

- Business purpose documentation Note how each expense relates to your business activities.

Special Considerations for 2025 Tax Planning

As we approach the 2025 tax year, keep these points in mind:

- Potential TCJA expiration The Tax Cuts and Jobs Act provisions are scheduled to expire after 2025, which could restore some deductions for employees.

- State tax considerations Some states still allow home office deductions for employees, even when federal law doesn’t.

- Business entity impact Your business structure (sole proprietor, LLC, S-Corp) affects how and where you claim home office deductions.

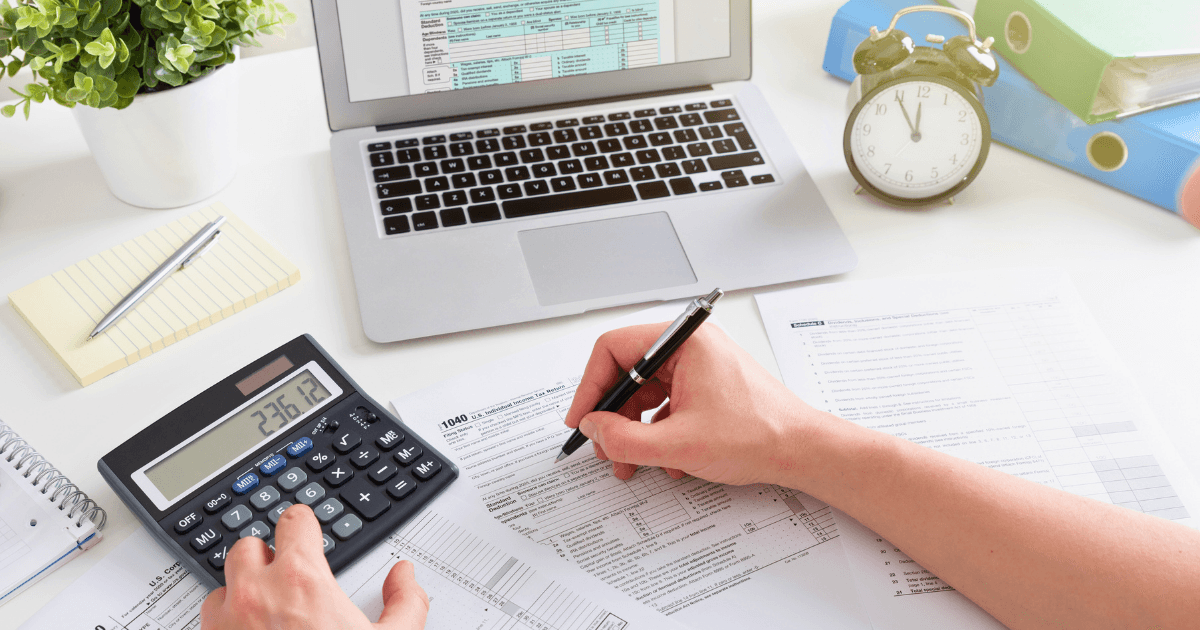

Case Study: Maximizing Home Office Deductions

Let’s look at how Sarah, a self-employed graphic designer, optimized her home office deductions:

Home details:

- 2,000 square foot home

- 200 square foot dedicated home office (10% of home)

- Annual home expenses: $30,000 (mortgage interest, property taxes, utilities, insurance, repairs)

Calculation options:

Simplified Method:

- 200 sq ft × $5 = $1,000 deduction

Regular Method:

- 10% of $30,000 home expenses = $3,000

- Plus direct office expenses of $1,500

- Total deduction: $4,500

By choosing the regular method, Sarah increased her deduction by $3,500, saving approximately $980 in taxes (assuming a 28% tax bracket).

The Bottom Line: Is a Home Office Deduction Worth It?

For self-employed individuals with qualifying home offices, the deduction is absolutely worth claiming. Even using the simplified method, a 300 square foot office generates a $1,500 deduction—potentially saving hundreds in taxes.

However, the key is doing it right:

- Ensure you meet all eligibility requirements

- Maintain thorough documentation

- Consider consulting a tax professional for complex situations

Remember: The goal isn’t to claim the largest deduction possible, but rather to claim every legitimate deduction you’re entitled to while staying compliant with tax laws.

Action Steps for Your 2025 Tax Planning

- Evaluate your status: Determine if you’re an employee or self-employed for tax purposes.

- Assess your home office: Does it meet the exclusive and regular use tests?

- Choose your calculation method: Compare the simplified vs. regular method to see which benefits you more.

- Implement a documentation system: Start tracking expenses and maintaining records now.

- Consider consulting a professional: Tax laws change frequently, and individual situations vary.

By understanding these rules and planning accordingly, you can maximize your legitimate deductions while minimizing your audit risk.