💰 Make Money Online

🤖 AI & Future Opportunities

✍️ Content & Audience Growth

📈 Marketing & Sales

🛠 Products & Services

🧠 Foundations & Mindset

🏆 Real-World Proof

In today’s digital-first financial landscape, investment apps have democratized access to the markets, allowing anyone with a smartphone to build wealth through investing. However, with dozens of platforms vying for your attention—each with their own unique features, fee structures, and user experiences—choosing the right investment app can be overwhelming.

The truth is, there’s no single “best” investment app for everyone. Your ideal platform depends on your investing style, financial goals, experience level, and psychological preferences. What works perfectly for a day trader might frustrate a long-term retirement saver, and vice versa.

This comprehensive comparison breaks down the top investment apps of 2025 by investor type, analyzing not just their features and fees, but also how well they align with different investing psychologies and behavioral tendencies. By understanding which platforms best match your personal investing style, you can make a more informed decision about where to grow your wealth.

Before diving into specific platforms, it’s important to understand how different psychological profiles influence investing preferences and behaviors.

Research in behavioral finance has identified several distinct investor profiles, each with unique psychological characteristics and platform needs:

Psychological Profile:

Platform Needs:

Psychological Profile:

Platform Needs:

Psychological Profile:

Platform Needs:

Psychological Profile:

Platform Needs:

Psychological Profile:

Platform Needs:

According to research from Quantilope, investor preferences vary significantly by age group, with younger investors (18-29) prioritizing features like zero trading fees and micro-investing, while older investors (40-49) value the ability to transfer existing portfolios and minimize balance requirements.

Now, let’s analyze which investment apps best serve each investor type, based on their unique features, costs, and psychological alignment.

Key Features:

Costs:

Psychological Alignment: Wealthfront’s “set it and forget it” approach helps passive investors avoid the behavioral pitfall of overtrading. According to NerdWallet, Wealthfront earned a perfect 5.0/5 rating for its automated investing capabilities, making it ideal for those who prefer minimal involvement in day-to-day investment decisions.

Key Features:

Costs:

Psychological Alignment: Betterment’s visualization tools help passive investors maintain perspective during market volatility, addressing the loss aversion bias that often leads to panic selling. Their goal-based approach also helps investors focus on long-term outcomes rather than short-term market noise.

Key Features:

Costs:

Psychological Alignment: M1’s visual “pie” approach to portfolio construction helps passive investors maintain a holistic view of their investments, reducing the tendency to focus too much on individual holdings. According to Forbes Advisor, M1 Finance is rated as the best platform for automated investing in 2025.

Key Features:

Costs:

Psychological Alignment: Webull’s comprehensive technical analysis tools cater to active traders’ need for control and information. The platform scored a perfect 5.0/5 in NerdWallet’s review, particularly for practice stock trading features that help mitigate the overconfidence bias common among active traders.

Key Features:

Costs:

Psychological Alignment: Interactive Brokers’ sophisticated platform appeals to active traders’ desire for maximum control and information. Research from DL.ACM.org suggests that active traders often exhibit overconfidence, which IBKR’s robust risk management tools can help counterbalance.

Key Features:

Costs:

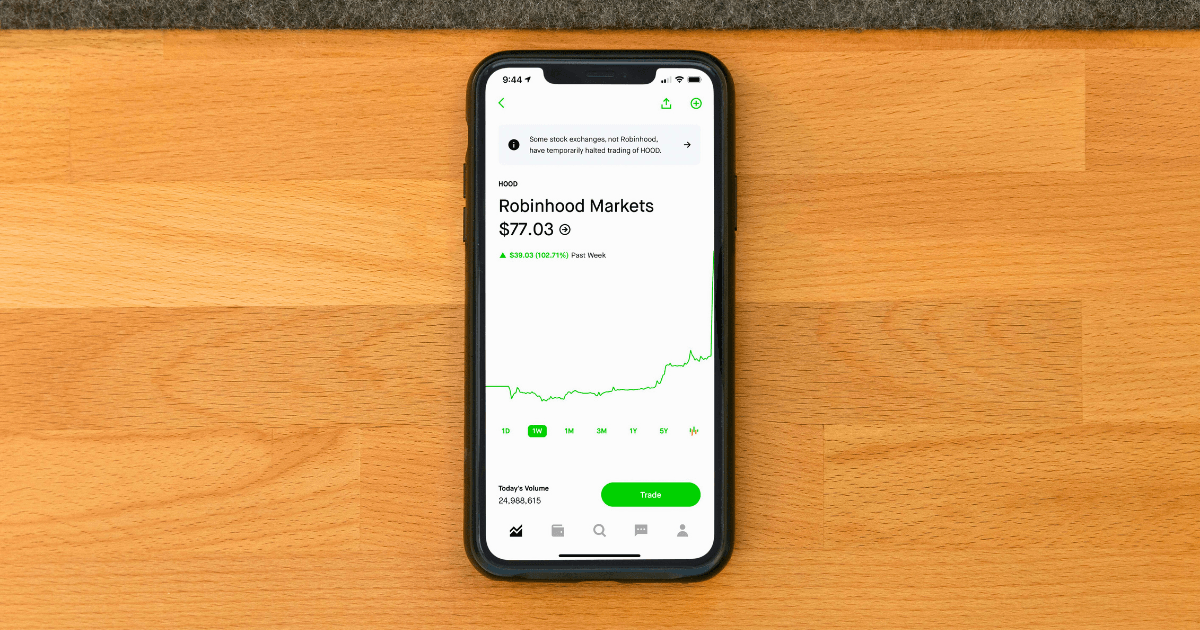

Psychological Alignment: Robinhood’s simplified interface appeals to active traders who value speed and ease of execution. However, this simplicity can sometimes encourage overtrading—a behavioral bias that active traders should be mindful of. According to Forbes, Robinhood ranks as the top investment app overall for 2025, particularly noted for its user-friendly interface.

Key Features:

Costs:

Psychological Alignment: Acorns’ round-up feature helps beginners overcome the psychological barrier of getting started by making investing automatic and painless. The app’s simplicity also reduces the anxiety many beginners feel about making investment decisions. Business Insider rates Acorns as the best app for micro-investing in 2025.

Key Features:

Costs:

Psychological Alignment: SoFi’s educational resources and financial planning sessions address beginners’ need for guidance and reassurance. The platform’s social features also tap into beginners’ tendency to seek social proof in their investment decisions. Business Insider highlights SoFi as a top choice for beginners in 2025.

Key Features:

Costs:

Psychological Alignment: Public’s social features help beginners overcome the isolation often felt when starting to invest. Research from Kubera suggests that familiarity bias leads new investors to favor investments they recognize—Public’s thematic collections help expand horizons beyond familiar brands.

Key Features:

Costs:

Psychological Alignment: Betterment’s transparent impact reporting helps socially conscious investors see the tangible difference their investments make, addressing the psychological need for value alignment between investments and personal beliefs.

Key Features:

Costs:

Psychological Alignment: Public’s community features allow socially conscious investors to connect with like-minded individuals, reinforcing their commitment to responsible investing. According to Forbes, Public is recognized for its transparency in 2025, a key consideration for socially conscious investors.

Key Features:

Costs:

Psychological Alignment: Fidelity’s comprehensive ESG research tools help socially conscious investors make informed decisions aligned with their values, addressing the need for transparency and credibility in sustainable investing claims.

Key Features:

Costs:

Psychological Alignment: Fidelity’s comprehensive approach appeals to wealth optimizers’ detail-oriented nature and desire for integration across their financial life. NerdWallet rates Fidelity as the overall best investment app in 2025, with a perfect 5.0/5 score.

Key Features:

Costs:

Psychological Alignment: Schwab’s research tools and tax optimization features appeal to wealth optimizers’ analytical mindset and focus on maximizing efficiency. According to Forbes, Charles Schwab is noted for its extensive research tools and integration with banking services in 2025.

Key Features:

Costs:

Psychological Alignment: Wealthfront’s advanced tax optimization features address wealth optimizers’ focus on efficiency and performance optimization. Their comprehensive financial planning tools also appeal to this investor type’s desire for holistic wealth management.

To help you make a more direct comparison, here’s how these platforms stack up across key features:

| Platform | Commission-Free Stocks & ETFs | Options Fees | Cryptocurrency Trading |

| Robinhood | Yes | $0 | Yes |

| Webull | Yes | $0 | Yes |

| Fidelity | Yes | $0.65/contract | Limited |

| Charles Schwab | Yes | $0.65/contract | No |

| Interactive Brokers | Yes | $0.65/contract | Yes |

| Public | Yes | No options trading | Yes |

| SoFi | Yes | No options trading | Yes |

| M1 Finance | Yes | No options trading | No |

| Betterment | Yes (within managed portfolios) | No options trading | No |

| Wealthfront | Yes (within managed portfolios) | No options trading | No |

| Acorns | Yes (within managed portfolios) | No options trading | No |

| Platform | Account Minimum | Management Fee | Premium Features Cost |

| Robinhood | $0 | $0 | Gold: $5/month |

| Webull | $0 | $0 | N/A |

| Fidelity | $0 | $0 | Personalized Planning: 0.35%+ |

| Charles Schwab | $0 | $0 | Intelligent Portfolios Premium: $30/month |

| Interactive Brokers | $0 (IBKR Lite) | $0 | IBKR Pro: Tiered pricing |

| Public | $0 | $0 | N/A |

| SoFi | $0 | $0 | N/A |

| M1 Finance | $100 | $0 | M1 Plus: $3/month |

| Betterment | $0 | 0.25% | Premium: 0.40% |

| Wealthfront | $500 | 0.25% | N/A |

| Acorns | $0 | $3/month | Family: $5/month |

| Platform | Fractional Shares | Automatic Rebalancing | Tax-Loss Harvesting | Crypto Trading |

| Robinhood | Yes | No | No | Yes |

| Webull | Yes | No | No | Yes |

| Fidelity | Yes | Yes (in managed accounts) | Yes (in managed accounts) | Limited |

| Charles Schwab | Yes | Yes (in managed accounts) | Yes (in managed accounts) | No |

| Interactive Brokers | Yes | No | No | Yes |

| Public | Yes | No | No | Yes |

| SoFi | Yes | Yes (in automated investing) | No | Yes |

| M1 Finance | Yes | Yes | No | No |

| Betterment | Yes | Yes | Yes | No |

| Wealthfront | Yes | Yes | Yes | No |

| Acorns | Yes | Yes | No | No |

The design of investment apps significantly influences user behavior, often in ways that investors don’t consciously recognize. Research from DL.ACM.org highlights how app features can blur the lines between investing and gambling, potentially encouraging irrational trading decisions.

These features can trigger dopamine responses similar to those experienced in gambling, potentially leading to increased trading frequency—which research consistently shows correlates with lower returns for retail investors.

Platforms like Betterment and Wealthfront incorporate these elements to encourage investors to maintain a long-term perspective, potentially counteracting behavioral biases that lead to poor investment decisions.

When selecting an investment app, consider these factors beyond just features and fees:

Be honest about your investing style and psychological tendencies. If you know you’re prone to overtrading when markets get volatile, a platform with automated features might be better than one with real-time trading capabilities, regardless of how appealing those features might seem.

Choose a platform that can grow with you. If you’re starting small but plan to significantly increase your investments, platforms with tiered services like Betterment or Fidelity might offer the scalability you need.

Most platforms offer demo accounts or simulations. Spend time using the interface to ensure it feels intuitive for your specific needs before transferring significant assets.

The quality of educational content can significantly impact your investing success, especially for beginners. Platforms like Fidelity and SoFi offer extensive learning resources that can help develop your investing knowledge.

Some platforms offer banking, lending, credit cards, and investing in one ecosystem. This integration can simplify financial management but may come at the cost of having best-in-class features in each category.

The “best” investment app isn’t necessarily the one with the most features or lowest fees—it’s the one that aligns with your psychological profile and investing goals. By understanding your investor type and how different platforms cater to various psychological tendencies, you can choose a platform that not only meets your technical needs but also helps you avoid common behavioral pitfalls.

Whether you’re a passive long-term investor who benefits from Wealthfront’s automated approach, an active trader who thrives with Webull’s technical tools, or a beginner who needs Acorns’ simplicity, the right platform can significantly impact your investing success.

Remember that your needs may evolve over time, and it’s perfectly acceptable to use different platforms for different aspects of your investing strategy. The most successful investors often combine multiple approaches, leveraging the strengths of various platforms to create a comprehensive investing ecosystem tailored to their unique financial journey.

What investment app features matter most to you? Share your experiences or questions in the comments below.