💰 Make Money Online

🤖 AI & Future Opportunities

✍️ Content & Audience Growth

📈 Marketing & Sales

🛠 Products & Services

🧠 Foundations & Mindset

🏆 Real-World Proof

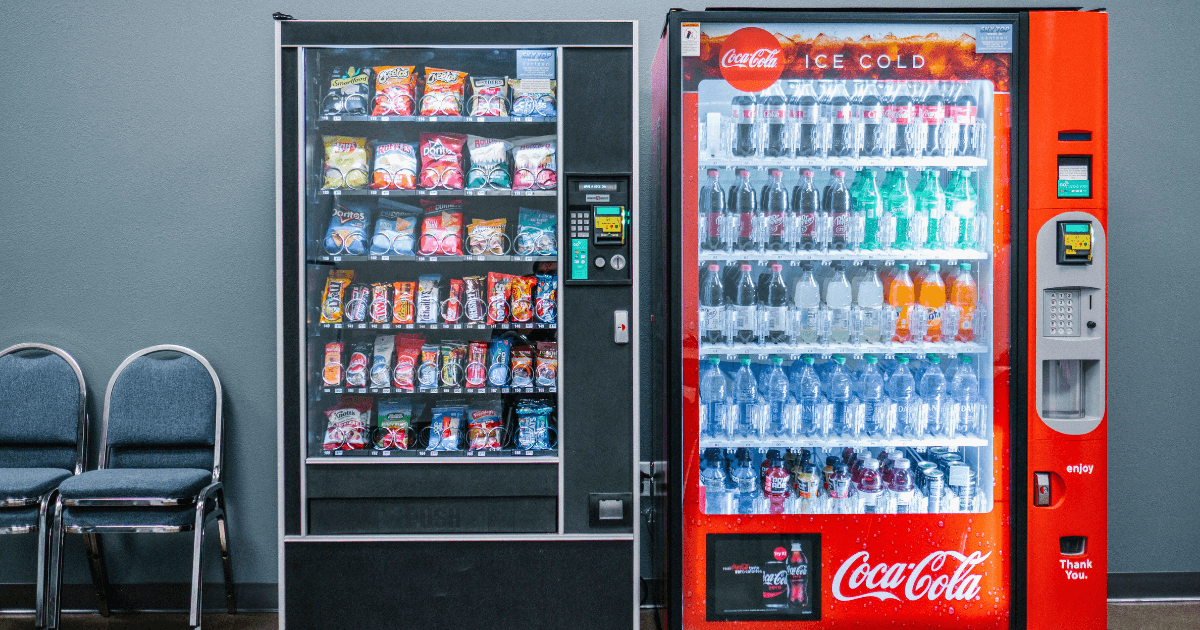

In the pursuit of financial freedom, I’ve always been drawn to business models that leverage systems over constant labor. Two years ago, I took the plunge into what many consider an “old-school” passive income stream: vending machines. Today, my 10-machine route consistently generates $1,000 in monthly profit with just 15-20 hours of work.

This isn’t about getting rich overnight—it’s about building a reliable wealth-generating asset that compounds over time. In this post, I’ll share the unfiltered reality of my journey: the initial investment, location strategies, profit margins, and psychological principles that transformed this side hustle into a wealth-building machine.

Before diving into my personal experience, let’s examine the current state of the vending industry:

While not as glamorous as crypto or real estate, vending machines offer something more valuable: a predictable, scalable system for building wealth with minimal time investment.

My journey began with extensive research and a calculated investment:

Initial Capital: $13,500

Expansion Capital (Reinvested Profits): $16,000

Total Investment: $29,500

While this might seem substantial, my 10-machine route now generates approximately $12,000 annually in profit—providing a complete return on investment in less than three years.

The single most critical factor in vending machine success is location. After several failures and successes, I developed a systematic approach:

My current location portfolio includes:

Pro tip: I offer property owners a choice between a flat monthly fee ($50-$100) or a percentage of sales (15-20%). Most choose the percentage, which aligns our incentives for machine performance.

Let’s examine the actual financial performance of my 10-machine route:

Monthly Revenue: $4,000

Monthly Expenses: $3,000

Monthly Profit: $1,000

While $1,000 monthly might not seem revolutionary, the hourly breakdown reveals the true value:

To make this a true wealth-building asset rather than another job, I’ve implemented systematic processes:

The key psychological principle here is creating systems that remove you from the equation—the business should operate whether you’re present or not.

My first three machines were placed in locations with insufficient foot traffic—a costly mistake. One machine in a prime location will outperform three machines in mediocre spots.

Implementation strategy: Develop a location scoring system based on foot traffic, competition, and demographic fit. Only place machines in locations scoring 8+ out of 10.

I initially stocked all machines identically, which proved inefficient. Now, each machine’s inventory is tailored to its specific location:

Implementation strategy: Track sales data religiously and adjust inventory every 30 days based on performance.

When I upgraded all machines to accept credit cards, mobile payments, and contactless options, sales increased by 35% overnight. In 2025, cash-only machines leave significant money on the table.

Implementation strategy: Factor payment processing technology into your initial machine selection, even if it means purchasing fewer machines initially.

Early in my journey, I operated reactively—fixing machines only when they broke down. This approach cost me thousands in lost sales and emergency repairs.

Implementation strategy: Create a preventative maintenance checklist and schedule quarterly service for each machine, regardless of apparent condition.

The path from 2 to 10 machines tested my resolve repeatedly. Equipment failures, location losses, and inventory issues created moments of doubt. The psychological principle that carried me through: focusing on systems rather than results.

Implementation strategy: Before expanding, ensure your existing machines are operating with minimal intervention. Only add machines when your current route is running efficiently.

Beyond the mechanical aspects of the business, specific psychological principles have proven crucial to my success:

Small, consistent actions compound dramatically over time. Adding just one machine per quarter allowed me to scale thoughtfully while reinvesting profits.

The vending business rewards patience. My first six months generated minimal profit, but laying the groundwork for systems and locations paid dividends later.

I’ve found that 20% of my products generate 80% of my revenue. Identifying these high-performers and optimizing their placement transformed my profitability.

Humans are more motivated to avoid losses than acquire gains. I leverage this by focusing on minimizing waste, preventing machine downtime, and eliminating stock-outs.

Rather than viewing other vending operators as competition, I’ve built relationships that have led to location referrals and equipment purchasing opportunities.

My journey included several costly mistakes you can avoid:

This business model isn’t suitable for everyone. Consider these factors before diving in:

Ideal for you if:

Not recommended if:

Looking ahead, my strategy includes:

My goal isn’t merely more machines—it’s more profit per machine through optimization and specialization.

If you’re intrigued by the potential of vending machines as a wealth-building vehicle, here’s a simplified roadmap to get started:

Remember: The vending machine business isn’t about getting rich quickly—it’s about building a reliable, semi-passive income stream that compounds over time.

If you’re considering the vending machine business, focus on these critical success factors:

The vending machine business may not be glamorous, but it offers something invaluable: a predictable path to building wealth through systems rather than constant labor.