Investment App Comparison: Which Platform Has the Best Features for Different Investor Types

In today’s digital-first financial landscape, investment apps have democratized access to the markets, allowing anyone with a smartphone to build wealth through investing. However, with dozens of platforms vying for your attention—each with their own unique features, fee structures, and user experiences—choosing the right investment app can be overwhelming.

The truth is, there’s no single “best” investment app for everyone. Your ideal platform depends on your investing style, financial goals, experience level, and psychological preferences. What works perfectly for a day trader might frustrate a long-term retirement saver, and vice versa.

This comprehensive comparison breaks down the top investment apps of 2025 by investor type, analyzing not just their features and fees, but also how well they align with different investing psychologies and behavioral tendencies. By understanding which platforms best match your personal investing style, you can make a more informed decision about where to grow your wealth.

Understanding Your Investor Type: The Psychology Behind Investment Preferences

Before diving into specific platforms, it’s important to understand how different psychological profiles influence investing preferences and behaviors.

The Five Primary Investor Types

Research in behavioral finance has identified several distinct investor profiles, each with unique psychological characteristics and platform needs:

1. The Passive Long-Term Investor

Psychological Profile:

- Values simplicity and automation

- Prefers “set it and forget it” approaches

- Lower risk tolerance and longer time horizons

- Less emotionally reactive to market fluctuations

Platform Needs:

- Automated portfolio management

- Low fees for long-term holding

- Goal-based planning tools

- Educational resources on long-term strategies

2. The Active Trader

Psychological Profile:

- Higher risk tolerance and comfort with volatility

- Enjoys the process of researching and selecting investments

- More susceptible to overconfidence bias

- Seeks the dopamine rush of successful trades

Platform Needs:

- Advanced charting and analysis tools

- Real-time data and news integration

- Low per-trade costs

- Wide range of tradable assets

3. The Beginner Investor

Psychological Profile:

- Uncertain about investment decisions

- May experience anxiety about potential losses

- Still developing financial literacy

- Often influenced by social proof and recommendations

Platform Needs:

- Intuitive, jargon-free interface

- Strong educational resources

- Fractional shares for low-cost entry

- Clear visualization of performance

4. The Socially Conscious Investor

Psychological Profile:

- Motivated by alignment between investments and personal values

- Willing to accept potentially lower returns for ethical satisfaction

- Seeks transparency in holdings

- Often community-oriented

Platform Needs:

- Robust ESG (Environmental, Social, Governance) screening tools

- Thematic investing options

- Community features and shared values

- Impact reporting

5. The Wealth Optimizer

Psychological Profile:

- Detail-oriented and analytical

- Focused on tax efficiency and fee minimization

- Values comprehensive financial planning

- Typically has more complex financial situations

Platform Needs:

- Tax optimization features

- Comprehensive financial planning tools

- Access to advisors for complex questions

- Advanced portfolio analysis

According to research from Quantilope, investor preferences vary significantly by age group, with younger investors (18-29) prioritizing features like zero trading fees and micro-investing, while older investors (40-49) value the ability to transfer existing portfolios and minimize balance requirements.

Comprehensive Platform Comparison by Investor Type

Now, let’s analyze which investment apps best serve each investor type, based on their unique features, costs, and psychological alignment.

Best Platforms for Passive Long-Term Investors

1. Wealthfront

Key Features:

- Automated portfolio management with regular rebalancing

- Tax-loss harvesting at all account levels

- Goal-based planning tools

- Smart Beta and Risk Parity for advanced users

Costs:

- 0.25% annual management fee

- $500 minimum investment

- No trading commissions

Psychological Alignment: Wealthfront’s “set it and forget it” approach helps passive investors avoid the behavioral pitfall of overtrading. According to NerdWallet, Wealthfront earned a perfect 5.0/5 rating for its automated investing capabilities, making it ideal for those who prefer minimal involvement in day-to-day investment decisions.

2. Betterment

Key Features:

- Goal-based investing with personalized portfolios

- Automatic rebalancing and dividend reinvestment

- Access to certified financial planners

- Socially responsible investing options

Costs:

- 0.25% annual fee (Digital plan)

- 0.40% annual fee (Premium plan with advisor access)

- No minimum balance for Digital plan

Psychological Alignment: Betterment’s visualization tools help passive investors maintain perspective during market volatility, addressing the loss aversion bias that often leads to panic selling. Their goal-based approach also helps investors focus on long-term outcomes rather than short-term market noise.

3. M1 Finance

Key Features:

- Custom “pie” portfolios for visual allocation

- Automated rebalancing and fractional shares

- Zero commission trades

- Integrated banking and borrowing options

Costs:

- Basic plan: Free

- M1 Plus: $3/month

- $100 minimum investment

Psychological Alignment: M1’s visual “pie” approach to portfolio construction helps passive investors maintain a holistic view of their investments, reducing the tendency to focus too much on individual holdings. According to Forbes Advisor, M1 Finance is rated as the best platform for automated investing in 2025.

Best Platforms for Active Traders

1. Webull

Key Features:

- Advanced charting with technical indicators

- Extended trading hours (4:00 AM to 8:00 PM ET)

- Paper trading for practice

- Options and cryptocurrency trading

Costs:

- No commission on stock and ETF trades

- No account minimum

- No inactivity fees

Psychological Alignment: Webull’s comprehensive technical analysis tools cater to active traders’ need for control and information. The platform scored a perfect 5.0/5 in NerdWallet’s review, particularly for practice stock trading features that help mitigate the overconfidence bias common among active traders.

2. Interactive Brokers

Key Features:

- Professional-grade trading platform

- Global market access (150+ markets in 33 countries)

- Advanced order types and algos

- Extensive research and screening tools

Costs:

- No commission on US stock and ETF trades

- No account minimum for IBKR Lite

- $10/month inactivity fee (waived under certain conditions)

Psychological Alignment: Interactive Brokers’ sophisticated platform appeals to active traders’ desire for maximum control and information. Research from DL.ACM.org suggests that active traders often exhibit overconfidence, which IBKR’s robust risk management tools can help counterbalance.

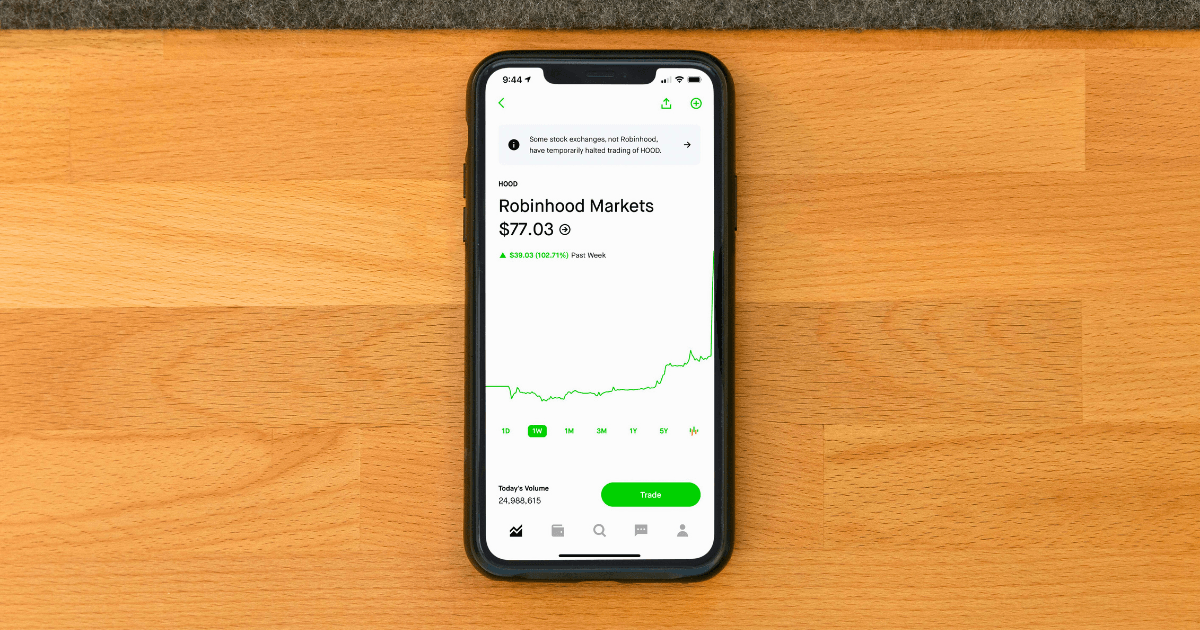

3. Robinhood

Key Features:

- Intuitive, streamlined interface

- Commission-free trading

- Instant deposit access

- Options and cryptocurrency trading

Costs:

- No commissions

- No account minimum

- Optional Robinhood Gold: $5/month

Psychological Alignment: Robinhood’s simplified interface appeals to active traders who value speed and ease of execution. However, this simplicity can sometimes encourage overtrading—a behavioral bias that active traders should be mindful of. According to Forbes, Robinhood ranks as the top investment app overall for 2025, particularly noted for its user-friendly interface.

Best Platforms for Beginner Investors

1. Acorns

Key Features:

- Round-up investments from everyday purchases

- Pre-built portfolios based on risk tolerance

- Educational content through “Money Basics”

- Cash back rewards that invest automatically

Costs:

- Personal: $3/month

- Family: $5/month

- No minimum investment

Psychological Alignment: Acorns’ round-up feature helps beginners overcome the psychological barrier of getting started by making investing automatic and painless. The app’s simplicity also reduces the anxiety many beginners feel about making investment decisions. Business Insider rates Acorns as the best app for micro-investing in 2025.

2. SoFi Active Investing

Key Features:

- Fractional shares for investing with as little as $1

- Free financial planning sessions

- IPO access for retail investors

- Integrated banking, lending, and investing

Costs:

- No management fees

- No commissions on stocks and ETFs

- No account minimum

Psychological Alignment: SoFi’s educational resources and financial planning sessions address beginners’ need for guidance and reassurance. The platform’s social features also tap into beginners’ tendency to seek social proof in their investment decisions. Business Insider highlights SoFi as a top choice for beginners in 2025.

3. Public

Key Features:

- Social community for investment ideas and discussion

- Fractional investing with no minimum

- Thematic investing through “Themes”

- Clear, jargon-free explanations

Costs:

- No commissions

- No account minimum

- Optional tipping model for trades

Psychological Alignment: Public’s social features help beginners overcome the isolation often felt when starting to invest. Research from Kubera suggests that familiarity bias leads new investors to favor investments they recognize—Public’s thematic collections help expand horizons beyond familiar brands.

Best Platforms for Socially Conscious Investors

1. Betterment (Socially Responsible Portfolios)

Key Features:

- Three distinct SRI portfolio options

- Climate impact portfolio focusing on low carbon emissions

- Social impact portfolio emphasizing diversity and inclusion

- Broad impact portfolio covering multiple ESG factors

Costs:

- 0.25% annual fee (Digital plan)

- No minimum balance

Psychological Alignment: Betterment’s transparent impact reporting helps socially conscious investors see the tangible difference their investments make, addressing the psychological need for value alignment between investments and personal beliefs.

2. Public

Key Features:

- ESG scores for companies

- Climate Commitment filter

- Thematic collections focusing on sustainable industries

- Community discussions around impact investing

Costs:

- No commissions

- No account minimum

Psychological Alignment: Public’s community features allow socially conscious investors to connect with like-minded individuals, reinforcing their commitment to responsible investing. According to Forbes, Public is recognized for its transparency in 2025, a key consideration for socially conscious investors.

3. Fidelity

Key Features:

- Extensive ESG research and screening tools

- Dedicated sustainable mutual funds and ETFs

- ESG score integration in stock research

- Active ownership through proxy voting

Costs:

- No commissions on stocks and ETFs

- No account minimum

- Expense ratios on sustainable funds vary

Psychological Alignment: Fidelity’s comprehensive ESG research tools help socially conscious investors make informed decisions aligned with their values, addressing the need for transparency and credibility in sustainable investing claims.

Best Platforms for Wealth Optimizers

1. Fidelity

Key Features:

- Comprehensive financial planning tools

- Tax-efficient investing strategies

- Access to human advisors

- Full-service wealth management options

Costs:

- No commissions on stocks and ETFs

- No account minimum

- Advisory services have separate fee structures

Psychological Alignment: Fidelity’s comprehensive approach appeals to wealth optimizers’ detail-oriented nature and desire for integration across their financial life. NerdWallet rates Fidelity as the overall best investment app in 2025, with a perfect 5.0/5 score.

2. Charles Schwab

Key Features:

- Extensive research and screening tools

- Tax-loss harvesting tools

- Comprehensive retirement planning

- Integration with banking services

Costs:

- No commissions on stocks and ETFs

- No account minimum

- Robo-advisor: 0.00% management fee (with cash allocation)

Psychological Alignment: Schwab’s research tools and tax optimization features appeal to wealth optimizers’ analytical mindset and focus on maximizing efficiency. According to Forbes, Charles Schwab is noted for its extensive research tools and integration with banking services in 2025.

3. Wealthfront

Key Features:

- Advanced tax-loss harvesting

- Direct indexing for accounts over $100,000

- Financial planning tools covering multiple life goals

- Portfolio line of credit

Costs:

- 0.25% annual management fee

- $500 minimum investment

Psychological Alignment: Wealthfront’s advanced tax optimization features address wealth optimizers’ focus on efficiency and performance optimization. Their comprehensive financial planning tools also appeal to this investor type’s desire for holistic wealth management.

Feature-by-Feature Comparison

To help you make a more direct comparison, here’s how these platforms stack up across key features:

Commission-Free Trading

| Platform | Commission-Free Stocks & ETFs | Options Fees | Cryptocurrency Trading |

| Robinhood | Yes | $0 | Yes |

| Webull | Yes | $0 | Yes |

| Fidelity | Yes | $0.65/contract | Limited |

| Charles Schwab | Yes | $0.65/contract | No |

| Interactive Brokers | Yes | $0.65/contract | Yes |

| Public | Yes | No options trading | Yes |

| SoFi | Yes | No options trading | Yes |

| M1 Finance | Yes | No options trading | No |

| Betterment | Yes (within managed portfolios) | No options trading | No |

| Wealthfront | Yes (within managed portfolios) | No options trading | No |

| Acorns | Yes (within managed portfolios) | No options trading | No |

Account Minimums and Fees

| Platform | Account Minimum | Management Fee | Premium Features Cost |

| Robinhood | $0 | $0 | Gold: $5/month |

| Webull | $0 | $0 | N/A |

| Fidelity | $0 | $0 | Personalized Planning: 0.35%+ |

| Charles Schwab | $0 | $0 | Intelligent Portfolios Premium: $30/month |

| Interactive Brokers | $0 (IBKR Lite) | $0 | IBKR Pro: Tiered pricing |

| Public | $0 | $0 | N/A |

| SoFi | $0 | $0 | N/A |

| M1 Finance | $100 | $0 | M1 Plus: $3/month |

| Betterment | $0 | 0.25% | Premium: 0.40% |

| Wealthfront | $500 | 0.25% | N/A |

| Acorns | $0 | $3/month | Family: $5/month |

Advanced Features

| Platform | Fractional Shares | Automatic Rebalancing | Tax-Loss Harvesting | Crypto Trading |

| Robinhood | Yes | No | No | Yes |

| Webull | Yes | No | No | Yes |

| Fidelity | Yes | Yes (in managed accounts) | Yes (in managed accounts) | Limited |

| Charles Schwab | Yes | Yes (in managed accounts) | Yes (in managed accounts) | No |

| Interactive Brokers | Yes | No | No | Yes |

| Public | Yes | No | No | Yes |

| SoFi | Yes | Yes (in automated investing) | No | Yes |

| M1 Finance | Yes | Yes | No | No |

| Betterment | Yes | Yes | Yes | No |

| Wealthfront | Yes | Yes | Yes | No |

| Acorns | Yes | Yes | No | No |

How Platform Design Influences Investor Behavior

The design of investment apps significantly influences user behavior, often in ways that investors don’t consciously recognize. Research from DL.ACM.org highlights how app features can blur the lines between investing and gambling, potentially encouraging irrational trading decisions.

Design Elements That May Encourage Overtrading

- Confetti animations for completed trades

- Push notifications about market movements

- Easy-access buy buttons with minimal friction

- Gamification elements like rewards and streaks

These features can trigger dopamine responses similar to those experienced in gambling, potentially leading to increased trading frequency—which research consistently shows correlates with lower returns for retail investors.

Design Elements That Promote Long-Term Thinking

- Goal tracking visualizations

- Performance metrics focused on progress toward goals rather than daily fluctuations

- Automatic rebalancing notifications

- Educational content integrated into the user experience

Platforms like Betterment and Wealthfront incorporate these elements to encourage investors to maintain a long-term perspective, potentially counteracting behavioral biases that lead to poor investment decisions.

Making Your Decision: How to Choose the Right Platform

When selecting an investment app, consider these factors beyond just features and fees:

1. Align With Your True Investor Type

Be honest about your investing style and psychological tendencies. If you know you’re prone to overtrading when markets get volatile, a platform with automated features might be better than one with real-time trading capabilities, regardless of how appealing those features might seem.

2. Consider Your Current and Future Needs

Choose a platform that can grow with you. If you’re starting small but plan to significantly increase your investments, platforms with tiered services like Betterment or Fidelity might offer the scalability you need.

3. Test Drive Before Committing

Most platforms offer demo accounts or simulations. Spend time using the interface to ensure it feels intuitive for your specific needs before transferring significant assets.

4. Evaluate Educational Resources

The quality of educational content can significantly impact your investing success, especially for beginners. Platforms like Fidelity and SoFi offer extensive learning resources that can help develop your investing knowledge.

5. Consider Integration With Your Financial Ecosystem

Some platforms offer banking, lending, credit cards, and investing in one ecosystem. This integration can simplify financial management but may come at the cost of having best-in-class features in each category.

Conclusion: The Best Platform Is the One That Fits Your Psychology

The “best” investment app isn’t necessarily the one with the most features or lowest fees—it’s the one that aligns with your psychological profile and investing goals. By understanding your investor type and how different platforms cater to various psychological tendencies, you can choose a platform that not only meets your technical needs but also helps you avoid common behavioral pitfalls.

Whether you’re a passive long-term investor who benefits from Wealthfront’s automated approach, an active trader who thrives with Webull’s technical tools, or a beginner who needs Acorns’ simplicity, the right platform can significantly impact your investing success.

Remember that your needs may evolve over time, and it’s perfectly acceptable to use different platforms for different aspects of your investing strategy. The most successful investors often combine multiple approaches, leveraging the strengths of various platforms to create a comprehensive investing ecosystem tailored to their unique financial journey.

What investment app features matter most to you? Share your experiences or questions in the comments below.